Build

Add assets like ETFs, mutual funds, or stocks. Embed portfolios within portfolios, choose between various algorithms, policies, and customize policy settings.

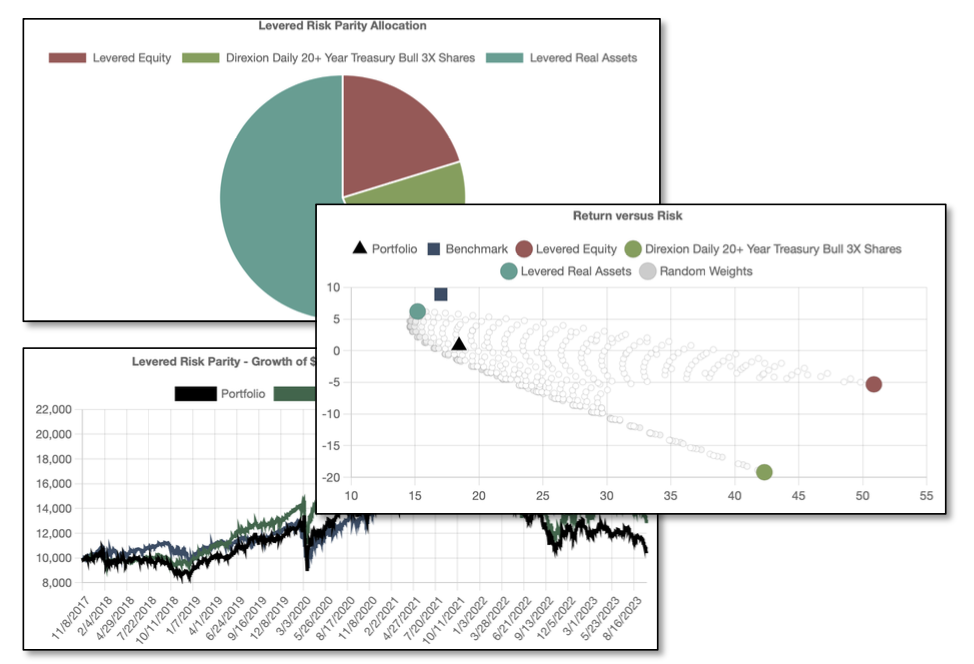

Analyze

Backtest portfolios with daily data; assess returns, risk, and correlation. Compare portfolios to benchmarks and visualize asset weight changes over time.

Implement

Calculate precise buy/sell actions to execute portfolio strategies.